JANE GOLLEY examines the implications of China’s gender imbalance for the Chinese and global economies—and comes up with some reassuring findings.

In 2013, China recorded an official sex ratio at birth (SRB) of 117.6 boys for every 100 girls, making it the most gender imbalanced country in the world, a rank it has held since the mid-1980s when the SRB first moved into the abnormal range, above 107.

The causes of China’s gender problem are multifaceted. And so are the potential consequences. I explored some of these with my colleague Rod Tyers using a global model that projects both economic and demographic outcomes through to 2030. Our research started with four observations.

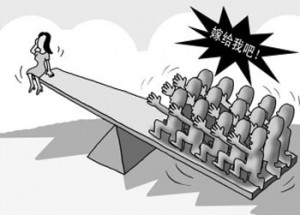

The first came from the work of Shang-jin Wei and his colleagues at Columbia University. Their empirical analysis used cross-provincial Chinese data to show that close to half of the rise in China’s household savings could be explained by the number of excess men in any given province. Arguing only as economists could, their logic was centred around a competitive marriage market in which single men would choose to save more to increase their chance of finding love—or at least, a wife.

High saving rates, in turn, provide the funds for domestic investment and hence domestic output expansion. But they also have international implications, with the excess of Chinese savings over investment fuelling China’s current account surplus (and the US current account deficit). Indeed, Qingyuan Du and Wei concluded that, while ‘the sex ratio imbalance is not the sole reason for global [economic] imbalances, it could be one of the significant, and yet thus far unrecognised factors’. We wanted to know if they were right.

Marrying up

Our second observation related to the phenomenon of hypergamy—that is, the practice of women (pretty universally) choosing to marry up, and the implication that it would be the least ‘desirable’ men that would end up being unmarried, or excess. Our model distinguishes between skilled and unskilled workers, and between genders, so we were able to separate out the unskilled men and project how many of these would be unmatched depending on our assumptions about who married whom. The resulting gender gap by 2030 was huge: in the range of 18 to 48 million men who could potentially be looking for a wife, but unable to find one.

Our third observation came from the work of Lena Edlund and her co-authors, also from Columbia University, whose empirical work linked the increase in China’s sex ratio to an increase in property and violent crime. We took this link one step further and suggested that a rise in the sex ratio would decrease labour productivity (since you can’t very well be productive when you’re out committing crimes). In particular, we assumed that this productivity decrease would hit unskilled male workers, whose marriage rates were lowest.

Our fourth observation was the announcement by the Chinese government in 2011 that reducing the sex ratio imbalance had become a national priority—with a host of new policies to clamp down on illegal prenatal gender tests and sex-selective abortions, to promote equal opportunities and raise the social status of women. The sex ratio at birth has in fact declined a little since this time.

Whether the recent downward trend in gender rebalancing can be sustained, and whether or not it is caused by effective government policies, self-correcting market forces, or nature itself, remains to be seen. What we wanted to do was ask the question, what if? So we ran a baseline projection for the model in which the SRB remained at current levels through to 2030. We then ran two further simulations that projected the SRB to trend towards normal levels by 2030.

Our first simulation linked the falling number of unmatched men as the SRB trended down to falling saving rates—which we quantified using the findings of Shang-jin Wei. This reduced investment, and therefore both GDP and per capita income, while it put very slight pressure on the exchange rate to appreciate because of a smaller supply of RMB in foreign exchange markets. This illustrated the point that gender rebalancing will actually have economic costs—that is, the imbalances of the past have had economic benefits.

But please don’t think we would use this finding to suggest that gender rebalancing shouldn’t occur! In our second simulation, we included both the negative impact of gender rebalancing via lower savings rate and the positive impact of gender rebalancing via crime reductions, and hence productivity improvements among unskilled male workers. Thankfully, the overall impacts on investment, GDP and per capita income were all positive—although things could have gone the other way if, say, the savings impacts are actually bigger and the productivity impacts smaller than Wei and Edlund’s work, respectively, had implied.

In sum, our modelling allowed us to explore the impacts of gender rebalancing on the Chinese and global economies. The impact on the Chinese economy was fairly small over the time period—mainly because it takes time for changes in birth rates to impact on changes in the workforce, the key link between demographic change and economic growth. Global impacts were small too, although this was important in itself because it enabled us to challenge Du and Wei’s dramatic claim above.

China’s gender imbalances are nothing to be proud of, but at least we managed to show they didn’t cause the global financial crisis!

Main photo:

A Chinese family with one child having a little picnic at Beihai Park in Beijing (Daniel Case, Flickr).